Which would you rather have in your house: a hearth or more windows? Kitchen renovations, room additions, and roof replacements are just some examples of the more substantial projects you may be contemplating. Though you may have grand designs for renovating your house, you must also consider how you will pay for all of these upgrades. If you need to finance a home repair project but don’t have enough cash on hand, look into home renovation loans.

Definition of Home Repair Loans

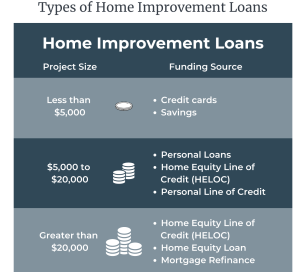

As with the types of house improvements you can make, the ways in which you can pay for them are diverse. For a house improvement project, you can choose from five different types of funding:

- Equity loan for the house (HELOC)

- The Equity in Your Home and a Loan

- Changes in a mortgage’s terms

- Individual Loans

- Using a credit card

Any of these lending choices can be used to get the money you need to fix up or enhance your home. Many options exist for obtaining a loan, but they differ greatly in terms of the maximum loanable amount, the complexity of the application process, and the fees involved. Each of these home-improvement loan options has different requirements in terms of minimum credit score, yearly income, loan amount, and interest rate. The size and length of your undertaking, as well as your available funds, will determine which option is most suitable. You can use a combination of loans, such as charging the costs on a credit card while you file for a home equity line of credit, to cover the cost of your home improvement job.

The following should be considered in order of importance when weighing the different financing options for home improvements:

- Money needed to acquire

- Quantity of money that can be borrowed

- How challenging it is to get a loan

Borrowing Money Based On The Appraisal Of Your Home

Borrowing Money Based On The Appraisal Of Your Home

A home equity loan is a loan that is secured by the equity in your property and has a fixed interest rate. Home equity loans offer low interest rates and are a fantastic option for financing large home improvement projects that require a sizable initial investment. The catch is that not all loans against a property’s value are considered home equity loans. You need 20% equity in your property before you can get a home equity loan.

Get a Loan Based on Your Home’s Value (HELOC)

Like a home equity loan, but with a larger maximum loan amount, a home equity line of credit (HELOC) is a type of revolving credit based on the borrower’s home equity. You can withdraw as much or as little money as you need whenever you like, up to your credit limit. HELOCs are a great choice for ongoing projects whose expenses can be paid in instalments over a period of time due to their low interest rates and flexibility. In this manner, you’ll be able to save borrowing for truly dire circumstances. Like a home equity loan, a home equity line of credit (HELOC) requires that you have at least 20% equity in your property if you already have a mortgage, or 35% equity for a HELOC that stands on its own.

With the help of access or bank cards, some HELOC providers make it even easier to manage your HELOC. You can use the money from your HELOC to buy whatever building supplies you need, whether from a local shop or online. The convenience of a HELOC with an access card is comparable to that of a credit card, but the interest rate and maximum loan amount are usually much more favorable with HELOCs. The minimum monthly payment on a HELOC, which consists of interest alone, is usually much lower than the minimum payment required on a credit card. Credit cards, on the other hand, usually necessitate a minimal monthly payment of at least one percent of the balance, plus interest.

Loan Refinancing

With a “cash-out refinance,” borrowers take out a new credit with a higher interest rate and principal in order to free up more cash from their mortgage. The borrowed amount is the distinction between your present and previous mortgage balances. The sum you’ve been awarded can be used to pay for the necessary home maintenance.

There may be fees or fines for refinancing your mortgage, depending on when you do it. The lender may charge you mortgage prepayment penalties if you refinance during the penalty term. When your mortgage’s term is up for renewal, refinancing is your best bet to avoid paying early termination costs. If you want to refinance your mortgage, your current provider may charge you a discharge fee.

When you refinance, you can borrow up to 80% of your home’s value; however, if you borrow more than this, you won’t qualify for the current cheap mortgage refinance rates. When building a new house or undertaking a large renovation, however, a home construction loan may be the best route to take.

https://jalabaze.com/2023/02/what-you-need-to-know-about-buying-a-home-in-new-brunswick/

borrowing funds

The application process for a personal loan is less time-consuming and more straightforward than that for a mortgage refinance or a home equity line of credit. One who needs money quickly to cover renovation expenses but doesn’t have enough equity in their home to qualify for a secured loan is a good candidate for this type of loan. Providing a comprehensive building plan to your financier could be the deciding factor in obtaining a lower interest rate. Estimating costs like paint usage can help you stick to your building plan and stay within your budget.

Personal loans and other types of unsecured credit typically have a higher interest rate than protected credit. An increased interest rate may also result from variables such as a low income or a low credit score.

Pay with a Charge Card

If you need money but know you won’t be able to pay it back soon, getting a loan on a credit card isn’t the best idea. An easy method to spread the cost of a relatively inexpensive home improvement project over a shorter time frame is to use a credit card. If you need more time to pay off the debt and cannot afford the minimum payment right away, financing home renovations with a credit card is not a good idea. However, most credit cards offer a 0 percent interest promotional period for the first 21 days. Some people will use a cash-back credit card to make urgent repairs to their homes before they receive their next paycheck.

Payment Plans for Shops

Several tools and home improvement retailers in Canada offer in-store credit card services. It’s possible that using these credit cards will grant you access to perks like a longer return policy, an extended guarantee, and price reductions. When you need a quick infusion of cash for a few minor house renovations, a store credit card can be a convenient and speedy solution.

The Canadian industry is dominated by Home Depot, with Lowe’s following closely behind. National home improvement retailers like Home Depot, Lowe’s, Rona, and others offer a wide range of credit services and financing choices to their customers. Participation in such schemes typically does not require either professional standing or prior training as a commercial contractor.

Retail financing efforts frequently partner with non-profits. Hardware shop chain BMR Group in eastern Canada is one of the many companies that uses Desjardins Accord D financing. Customers of Castle Building Centres can get instant financing through Flexiti. A joint venture between Timber Mart and Fairstone Financial.

Hardware Stores Like Home Depot

It’s true that Home Depot offers credit cards to both individuals and companies. Any person may apply for a Home Depot credit card or a building loan. In order to better serve their industrial clientele, Home Depot offers both a commercial account and a commercial credit card. Both the business account and the revolving card function similarly to a charge card or credit card in that they require regular payments to keep their amounts from going into the negative. Home Depot business customers with a Pro Business Account and Pro Xtra Rewards may be eligible for a promotional time of 60 days with no interest charged on certain purchases made with their business Revolving Card or Commercial Account.

Credit Card for the Home Depot Store

- Rate of Interest, 28.80%

- One year extension on the return policy

- Zero percent financing with a minimum buy

The Home Depot Consumer Credit Card is issued by Citi Cards Canada (Citibank), with which Home Depot has an affiliation. The card is easy to apply for in-store or online, and it comes with benefits like a yearlong return window. If you use any other form of money, you’ll only have 90 days to request a refund. Only Home Depot credit users can access these special offers. Remember that your Home Depot Credit Card transactions serve as collateral for the credit limit. Home Depot reserves the right to reclaim any merchandise purchased on your Home Depot credit card in the event that payment is past due.

The Home Depot Credit Card’s interest rate will increase from 23.25% to 28.80% in March 2020. Current APR for The Home Depot Credit Card is 28.80% p.a., which is significantly higher than the average APR for other credit cards. The interest rate is also significantly greater than that of standard consumer credit cards. The yearly fee on this credit card is $0. For those who only require short-term funding for renovation costs, the card comes with a variety of offers to help offset the high interest rate.

If you establish a credit card account at The Home Depot and make a purchase of $1,000 or more within the first 30 days, you will receive a one-time promotional discount of $100. No interest will be charged on any purchases over $299 if the amount is paid in full within 6 months. Rates will increase to 28.8% in the seventh month. If you spend more than $299 on major home appliances or properly installed projects, you can take advantage of a 0% APR promotion for 12 months.

There are a variety of areas where you can find offers with zero percent interest for 18 months, and they change frequently. For example, if you purchase a heating, ventilation, and air conditioning system between October 14, 2021 and December 8, 2021 for $2,000 or more, you won’t have to pay any interest on the purchase for 18 months.

As an Illustration, Let’s Look at How a Home Depot Credit Card Operates

How much interest would I pay on a Home Depot credit card debt of $10,000? A rate of 28.80% per year is added to your balance. Taking into account a 12-month borrowing term:

- The Amount We Are Borrowing is $10,000.

- Rate of Interest, 28.80%

- Indicative of One Year’s Time

If the sum remains unchanged at $10,000 for the entire year, the interest cost will be $2,880. Minimum monthly payments of one percent plus interest will be required. Thus, the initial minimal payment would be $100 plus $240 in interest, totaling $240. If the entire amount is paid before the end of the grace period (25 days), no interest will be charged on the previous billing cycle.

Get a Home Store mortgage to fund your next major renovation.

- Loan Rate: 8.99%

- Obtain a loan of up to $50,000 with no origination fees.

- The shopping period is 6 months and the payment period is 5 years.

For larger items, you can get a loan from Home Depot at a lower interest rate than you would get with their store credit card. A no-interest, no-collateral loan of up to $50,000 is available at Home Depot for in-store and online transactions. For the length of the project, you are prohibited from making any purchases with the loan funds. You can make a purchase anytime within the next six months. The length of the loan is 60 months (or five years) after the conclusion of the purchase period.

The annual percentage rate (APR) on the project funding is 8.99%, and there are no annual fees. In 2020’s February, the interest rate on a Home Depot Project Loan would increase from 6.99% to 8.99%.

Make as many prepayments as you need to, or pay off the complete loan for the project, without penalty. If you need more time than six months to complete the buying for your project, you can apply for additional project loans.

An Example of a Loan for a Unique Purpose

Imagine you have a ten thousand dollar budget and can only buy supplies for your next construction project from Home Depot. The Project Loan offers a loan of up to $10,000 for a term of up to 5 years at an interest rate of 8.99%. How much would it cost to obtain money from Home Depot using their Project Loan?

- The Amount We Are Borrowing is $10,000.

- Loan Rate: 8.99%

- Tenure: Five Years

Monthly payments, at the present interest rate, amount to $208. The total loan balance ($12,452) is paid back over the course of the loan’s 5-year payback period. For a Project Loan of $10,000, this equates to an interest payment of $2,452.

Lowes

Home Depot Consumer Credit Card

- Rate of Interest, 28.80%

- For orders over $299, there will be no interest charged for 6 months.

- In-store applications receive a one-time rebate of 10%.

Like the Home Depot card, the Lowe’s credit card offers promotional periods with no interest charges. We offer 6 months of interest-free financing on purchases over $299 with no installments required during that time. For select purchases and other areas, you can get up to a year with no interest or payments required. Our extended payment plans for purchases over $1,499 provide up to 48 months to pay at an interest rate of 8.99%. Credit card transactions for Lowe’s are handled by Synchrony Financial Canada. In-store registration entitles you to a one-time deal of 10% off your purchase (up to $100) in the given location.

Lenders for Lowe’s Commercial Operations

- No payments or interest for 60 days

- Every day, get a 5% reduction on everything.

- When you register in-person, you’ll receive a one-time discount of 10%.

Any time you use your Lowe’s Business Account Credit Card, you’ll get a 5% rebate. Also, you’ll save up to $100 off your purchase thanks to a 10% rebate. For larger companies, Lowe’s offers a commercial account receivable that makes it easier to track expenses and stock levels.

Rona

Most of Rona’s financing choices, such as the Rona Visa Desjardins credit card and the Rona Commercial products, were discontinued as of January 2021. Rona currently only accepts monthly payment plans as a means of payment.

Rona’s multi-purchase plan lets you make installments over two months with no interest on any home improvement items you buy. When you make a purchase of $99 or more within the first three months, you won’t be charged any interest; when you make a purchase of $299 or more within the first six months, you won’t be charged any interest either. Rona allows you to divide up your payments into manageable weekly chunks. A total of 24, 36, 48, or 60 equal monthly installments are required.

Rona provides a financing option with an interest rate that changes depending on the final purchase price. For purchases over $2,500, the APR is 4% for 24 months, while it is 13.5% for purchases under that amount. Finance options are available through Desjardins Accord D, which can be used to make orders from Rona.

Case Study in Rona Financing

In terms of annual interest rate, how much would Rona have to pay extra for a debt of $3,000 as opposed to $2,000?

Compared to a loan of $2,000 over the same time period, the interest payments on a debt of $3,000 will be lower. Interest on a loan of $3,000 for three years would amount to $285.57, while interest on a loan of $2,000 for the same term would be $443.34. To borrow $3,000 over the same time frame would cost you $727.77, which is more than double the cost of borrowing $2,000 over the same time frame ($485.18).

Should I Get a Loan for Home Improvements?

Improvements to your home can boost more than just its market worth. Remodeling can improve both the aesthetics and practicality of your home, enhancing your standard of life. Making your home more energy efficient and saving money on your utility costs is just one of many possible outcomes. The icing on the cake is that home renovations can boost your home’s resale worth, which can more than make up for the initial investment. The truth that you just finished a renovation could also be appealing to buyers.

If you have a clear vision for your home and can afford to pay for it in its entirety, including the monthly payments on a home renovation loan, then a makeover may be the way to go. Instead of waiting until you have enough savings to make the necessary renovations, you can ask for a renovation loan. There are some stores that will give you a loan or a credit card with no interest for a certain amount of time. You can use this as temporary financing while you look for more long-term options. Remember that even the most basic credit cards typically offer a 0% interest moratorium period if the balance is settled in full within a certain time frame.

There is, however, a loan associated with the renovation of one’s dwelling that must be paid back. You can easily live beyond your means if you take out a second mortgage or a home equity line of credit. Making a plan ahead of time is crucial if you don’t want to blow through your funds. If you won’t be able to handle the increased monthly payment that comes with a home renovation, you might want to rethink the project. This is due to the fact that remodeling loans are just that: loans, and not free money.